Post Office PPF Scheme 2026: Every parent wants to give their child a strong and secure future, especially when education costs and career opportunities are becoming more expensive each year. Planning early helps reduce financial pressure later in life. One reliable way to do this is through the Post Office Public Provident Fund, commonly known as the PPF scheme. This government-backed savings plan focuses on long-term growth, safety, and tax benefits. By investing a fixed amount every year, even something manageable like ₹25,000, parents can slowly build a meaningful fund for their child without taking market risks.

Why Long-Term Saving Matters for Children

Saving for a child’s future is not about quick returns, but about consistency and patience. Small but regular investments made over many years can grow into a large amount due to compound interest. When parents start early, time works in their favor. This approach also removes stress during important stages like higher education, professional courses, or skill training. The PPF scheme supports this long-term thinking by encouraging disciplined saving rather than risky short-term investments.

Key Features of Post Office PPF Scheme

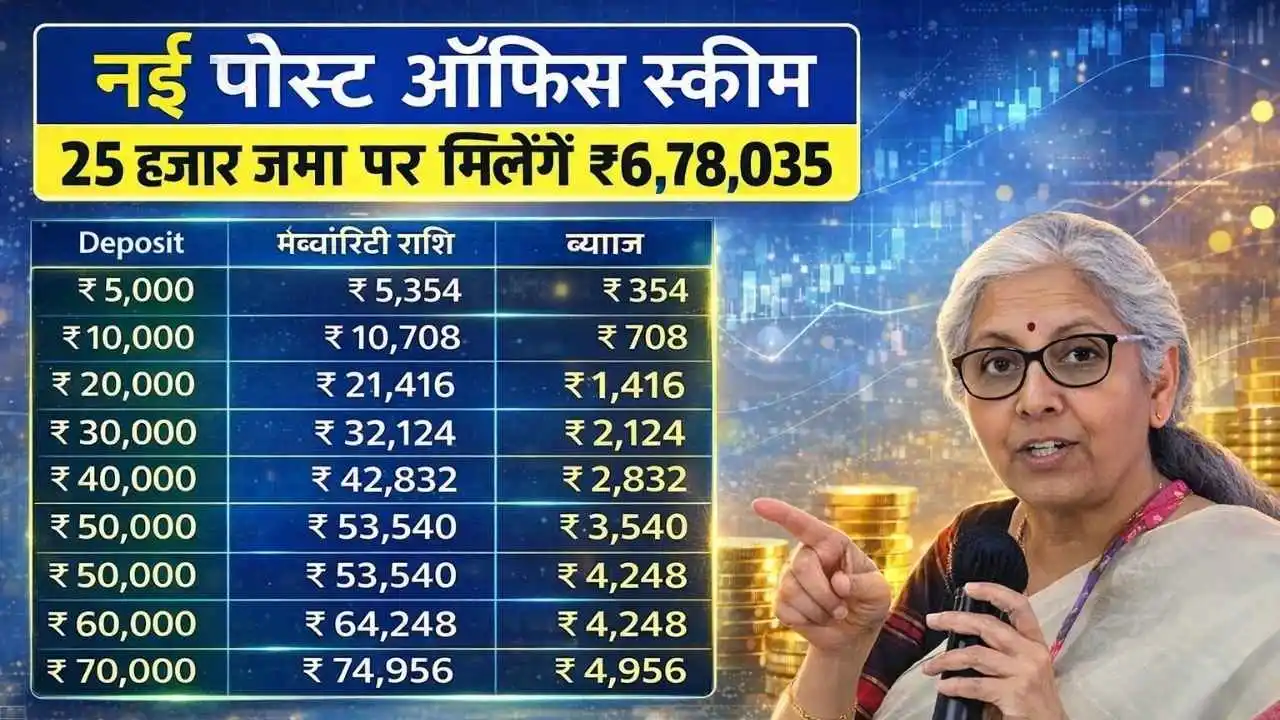

| Feature | Details |

|---|---|

| Scheme Name | Public Provident Fund (PPF) |

| Who Can Open | Indian residents, parents/guardians for minors |

| Where Available | Post Offices and selected banks |

| Account Duration | 15 years, extendable in 5-year blocks |

| Minimum Deposit | ₹500 per year |

| Maximum Deposit | ₹1.5 lakh per year |

| Suggested Investment | ₹25,000 yearly for long-term planning |

| Interest Rate | Set by Government of India, reviewed quarterly |

| Interest Credit | Compounded yearly |

| Tax Benefit | EEE category (fully tax-free) |

| Withdrawal Rules | Partial withdrawal after 7 years |

| Loan Facility | Available between 3rd and 6th year |

| Risk Level | Very low, government-backed |

What Is the Post Office PPF Scheme

The Post Office PPF scheme is a savings plan supported by the Government of India, designed for people who want safe and steady growth. It comes with a fixed tenure of 15 years, which can be extended further in blocks of five years. Parents or legal guardians can open a PPF account in the name of a minor child and manage it until the child becomes an adult. The scheme is popular because it combines security, guaranteed returns, and strong tax benefits.

How Investing ₹25,000 a Year Helps

Investing ₹25,000 every year may look small, but over 15 years it can grow into a solid amount due to compound interest. Since the interest earned is added back to the account every year, the money starts earning interest on interest. This steady growth helps parents create a dependable education fund without worrying about market ups and downs. Over time, this habit turns saving into a strong financial shield for the child.

Lock-In Period and Its Benefits

The 15-year lock-in period of the PPF scheme is actually a positive feature for parents saving for their child. It prevents unnecessary withdrawals and keeps the money focused on long-term goals. This discipline ensures that the funds remain untouched until they are truly needed. When the child reaches college age or plans for advanced education, the savings are already in place and ready to support those dreams.

Safety and Stability of the Scheme

One of the biggest strengths of the Post Office PPF scheme is its safety. Since it is backed by the Government of India, there is almost no risk involved. Unlike market-linked investments, PPF is not affected by stock market crashes or economic uncertainty. This makes it ideal for parents who prefer stable and predictable returns over high-risk options.

Tax-Free Growth Advantage

The PPF scheme offers triple tax benefits, which makes it very attractive for long-term planning. The money invested qualifies for tax deduction under Section 80C. The interest earned is completely tax-free, and the final maturity amount is also exempt from tax. This means whatever amount you receive at the end belongs fully to you and your child, without any deductions.

Flexibility for Every Family

The PPF scheme is suitable for families from all income groups. Parents can start with a small amount and increase the contribution later when income improves. Even if someone misses a year, the account can be reactivated by paying a small penalty. This flexibility makes the scheme practical and easy to manage over many years.

Partial Withdrawals and Loan Option

Although PPF is a long-term scheme, it also offers limited flexibility in emergencies. Partial withdrawals are allowed after the completion of seven years, and loans can be taken between the third and sixth year. These features provide financial support without breaking the long-term saving plan completely.

Things Parents Should Keep in Mind

Parents should make deposits regularly before the deadline to earn full interest for the year. Keeping records, using online tracking where available, and avoiding missed contributions can help maximize returns. It is also important to remember that the total annual limit of ₹1.5 lakh applies across all PPF accounts held by an individual.

Final Thoughts

The Post Office PPF scheme is a thoughtful and responsible way to secure a child’s future. By investing ₹25,000 every year, parents can slowly build a strong, tax-free fund without stress or risk. This scheme is not about fast money, but about creating long-term stability and peace of mind. Starting early makes a big difference, and the PPF scheme helps parents turn small yearly savings into a meaningful future gift for their child.

Disclaimer

This article is for informational purposes only. Interest rates and rules may change as per government decisions. Readers are advised to consult official Post Office sources or financial experts before making investment decisions.